If your personal information was stolen in a cyberattack, you could be owed money. A data breach lawsuit is one way to recover that compensation. Companies have a legal duty to protect your sensitive data. When they fail, the law gives you the right to take action.

Thousands of people file claims every year. Some individuals receive cash payments, others get free identity monitoring, and some qualify for both. But every case has deadlines—and missing them means losing your chance to collect.

This guide explains how this data breach lawsuit works, how much you could get, and what steps to take now. You’ll see examples of recent settlements and learn how to file your claim.

What Is a Data Breach Lawsuit?

A data breach lawsuit is a legal action taken against an organization or agency that neglected to secure personal information against hackers or illegal access. Examples of stolen data include Social Security numbers, bank account information, medical records, and login credentials.

Victims may receive:

- Cash for documented losses

- Reimbursement for identity theft costs

- Privacy impact payments

- Free credit monitoring

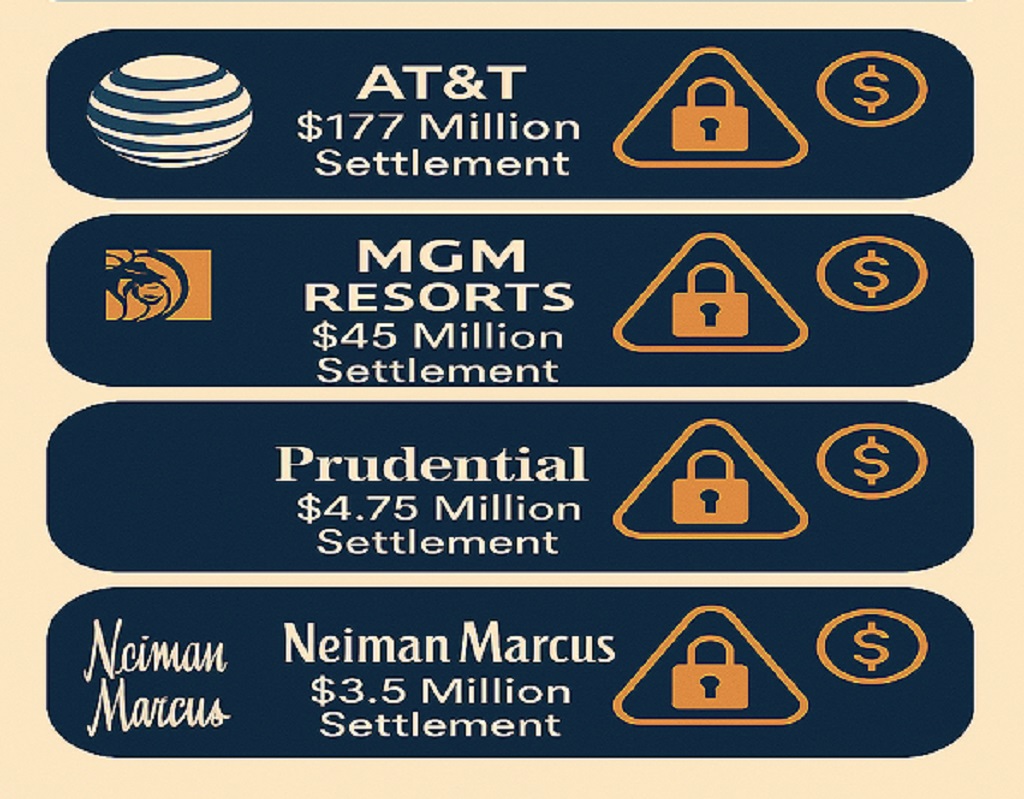

You can file individually or join a data breach class action settlement in 2025 with other victims. Recent cases, such as AT&T ($177M), MGM Resorts ($45M), and Prudential ($4.75M), demonstrate that payouts can be substantial. Act quickly—deadlines are strict, and missing them means no compensation.

Recent Serious Data Breach Settlements You Should Know

Several well-known businesses have settled data breach lawsuits for millions of dollars. You might still be able to claim if you had an account with one of these companies during the impacted time.

AT&T – $177 Million Settlement

AT&T agreed to pay $177 million to resolve lawsuits over two separate breaches in March and July 2024.

- First breach: payouts up to $5,000 for documented losses.

- Second breach: payouts up to $2,500.

- All victims get free credit monitoring and identity protection services.

If you had an AT&T account during these incidents, you may be part of the settlement. Check the official claim site for eligibility and deadlines.

MGM Resorts – $45 Million Settlement

MGM Resorts faced lawsuits after cyberattacks in 2019 and 2023. The company agreed to a $45 million preliminary settlement.

- Eligible customers may receive cash or credit monitoring.

- Details depend on proof of identity theft or financial harm.

If you stayed at an MGM property during the breach period, it’s worth checking if you qualify.

Prudential Financial – $4.75 Million Settlement

Prudential’s February 2024 data breach exposed Social Security and tax ID numbers.

- Up to $5,000 for documented losses.

- Impact payments of $200–$599 for Social Security or TIN exposure.

- California residents can get $100–$599 under the CCPA.

You must submit proof of impact or losses before the claim deadline to receive payment.

Neiman Marcus—$3.5Million Settlement

Neiman Marcus settled claims over a May 2024 breach affecting payment and personal data.

- Cash payments are available for identity theft or fraud damages.

- Free credit monitoring is offered to all affected customers.

If you made purchases during the breach period, check your statements and consider filing.

Apria Healthcare – $6.37 Million Settlement

Apria Healthcare agreed to pay $6.37 million after a breach that exposed sensitive patient data, including medical histories and insurance details.

Cash reimbursement for proven losses.

Free credit and medical monitoring.

Healthcare data breaches can lead to both identity theft and medical fraud, making these settlements especially important.

Boston Children’s Health Physicians – $5.15 Million Settlement

This September 2024 breach compromised medical records and personal details.

- Cash payments for financial harm.

- Two years of free medical data monitoring for all class members.

If you received a notice from the provider, you’re likely eligible.

Enzo Biochem – $2.8 Million Settlement

Enzo Biochem resolved claims after a breach compromised laboratory patient data.

- Up to $10,000 for documented losses.

- Automatic credit monitoring for all affected patients.

Must Read: Chime Class Action Lawsuit: What You Need to Know

Pending Data Breach Lawsuits You Should Watch

New cases can turn into payouts fast. You should track these active lawsuits and claims in progress.

Samsung website data-sharing lawsuit

A new class action lawsuit claims that Samsung collects and shares website visitors’ private data despite “privacy” settings. The case was filed in California. It targets alleged tracking of user communications and browsing activity on Samsung’s sites. If you visited Samsung’s websites, you should follow this case for updates and possible relief.

- Claims include tracking user communications and browsing activity without consent.

- If the court certifies the class, eligible consumers may qualify for privacy violation payments and free identity monitoring.

Duo Broadband & Communications Data Group breach cases

Two federal class actions in Illinois claim Duo Broadband and Communications Data Group failed to safeguard customer PII and delayed breach notices. Plaintiffs say names, addresses, dates of birth, and Social Security numbers were exposed. If you were a current or former customer, you should save your records and watch for a settlement website or mailed notice.

- Failing to safeguard personally identifiable information (PII).

- Delaying breach notification to customers.

Arisa Health – $1.9 Million Proposed Settlement

While technically in settlement talks, the Arisa Health breach case from March 2024 is one to watch.

- Sensitive patient data was exposed, including medical history and insurance details.

- Final court approval could open claims for medical identity theft protection and reimbursement for documented losses.

Navvis Healthcare Breach Lawsuit

Navvis faces litigation after a cyberattack compromised health plan member data.

- Allegations include negligence in cybersecurity practices.

- Potential compensation could include medical fraud monitoring and cash payouts.

Why these cases matter to you

- Courts often approve credit monitoring plus cash for documented losses once cases settle. See MGM’s $45M framework as a recent example.

- Early tracking helps you meet claim deadlines and organize proof, such as bank statements, fraud reports, or time spent dealing with identity theft.

Higher payouts. Some settlements offer tiered payments, allowing early claimants to secure full benefits before reaching caps.

Your Rights After a Data Breach

If a company loses your personal data, the law gives you protection. These rights help you recover money, prevent further harm, and hold the business accountable.

Right to be Notified

Most states require companies to notify you after a breach. The notice must explain:

- What information was exposed?

- When the breach happened.

- What steps can you take now?

Some states, like California, set strict deadlines for sending these notices.

Right to Compensation

If the breach caused you financial harm, you may be able to claim money through:

- A class action settlement.

- An individual lawsuit.

- State-specific privacy laws, such as the California Consumer Privacy Act (CCPA).

You can claim for out-of-pocket costs, lost time, and sometimes for emotional distress.

You can claim reimbursement for:

- Out-of-pocket expenses related to identity theft.

- Lost time spent dealing with fraud.

- Emotional distress in some instances.

Right to Free Credit and Identity Monitoring

Many settlements include free credit monitoring and identity theft protection. This helps you catch fraud early. Many settlements include 1–3 years of credit monitoring and identity theft protection. These services:

- Alert you to new accounts opened in your name.

- Help you spot fraudulent transactions.

- Offer recovery support if your identity is stolen.

Right to Privacy Under Federal Laws

While the U.S. has no single federal privacy law, specific industries follow strict rules:

- Medical information is protected under HIPAA.

- The Gramm-Leach-Bliley Act protects financial information.

Penalties for noncompliance might be harsh if the violating company is subject to these laws.

Federal vs. State Protections

- Faster remedies are frequently offered by state legislation, particularly in places like California, New York, and Illinois that have robust privacy protections.

- Although federal laws are applicable nationwide, they are frequently industry-specific.

- For greater legal clout, some lawsuits combine federal infractions with state consumer protection allegations.

Step-by-Step Claim Filing Guide

Following a breach, prompt action might mean the difference between receiving compensation and losing out. To protect yourself and get your reward, take these actions.

Step 1 – Verify That You Were Affected

Examine the breach notification that was sent to you by email or the mail.

- Check for the name of the company, the date of the breach, and the kind of data that was made public.

- Use the firm name plus “data breach” to look for breach announcements online if you were not notified but believe you may be impacted.

Step 2 – Find the Settlement’s Official Website

Use links only from reliable sources, such as government authorities, law firm announcements, or the settlement administrator.

- Avoid random links on social media.

- The official site will end with .com, .org, or .gov and list a claims administrator.

Step 3 – Gather Proof of Loss

Many settlements require proof before you can receive higher payments. This can include:

- Bank statements showing unauthorized charges.

- Police or FTC identity theft reports.

- Please provide receipts for the credit monitoring you purchased.

- Emails or letters from creditors about fraudulent activity.

Step 4 – Complete the Claim Form

Fill out every section of the form accurately.

- Provide your contact details and claim ID if you have one.

- Attach your proof documents if you are claiming losses.

- Double-check deadlines before submitting.

Step 5 – Keep Copies of Everything

Save a PDF or printed copy of your claim submission.

- Record the date and confirmation number.

- Keep all breach notices in case of future disputes.

Step 6 – Monitor Your Claim

Log back into the settlement site occasionally.

- Watch for requests for more information.

- Track the approval date and estimated payment schedule.

Step 7 – Protect Your Personal Information Long-Term

Your data can still be in danger even after you make a claim.

- Create strong, one-of-a-kind passwords.

- Turn on two-factor verification.

- At least three times a year, check your credit reports.

Must Read: Nelnet Lawsuit: Complete Legal Guide for Borrowers

Time is of the essence if a data breach lawsuit impacts you. Every settlement has specific dates, and if you miss them, your claim will be rejected. Payouts for data breaches can amount to hundreds or even thousands of dollars, as seen by recent cases against AT&T, MGM Resorts, Prudential, and Neiman Marcus.

Check official settlement websites today, confirm your eligibility, and submit your claim before it’s too late. Protect your identity, recover your losses, and take advantage of free credit monitoring when offered. A few minutes now could lead to significant compensation. Don’t wait—your chance to benefit from a data breach lawsuit is here.

Disclaimer: This article provides a general overview of the Data Breach lawsuit, based on publicly available information, and is intended for informational purposes only. It is not legal advice.

Musarat Bano is a content writer for JudicialOcean.com who covers lawsuits, legal news, and general legal topics. Her work focuses on research-based, informational content developed from publicly available sources and is intended to support public awareness. She does not provide legal advice or professional legal services.